Here are some IRS Tax Tips for homeowners to consider when considering selling a home.

Read MoreLearn about the newest addition to the Doty team - Karen!

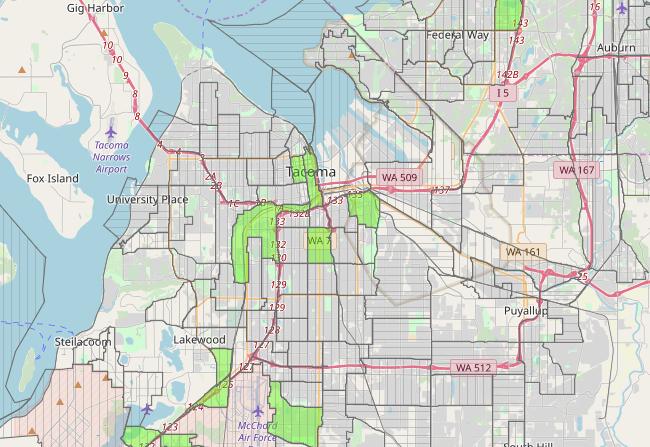

Read MoreThe Doty Group was voted Best of the South Sound Medium Business for 2019!

Read MoreQuickBooks has recently announced the ability for small businesses to get paid the next day from ACH payments easily and affordably, ensuring small businesses can improve cash flow no matter the payment they accept.

Read MoreFor organizations that are quickly-growing, consistently introducing new products or services, and entering or navigating the world of e-commerce, up-to-date compliance software is a must-have when it comes to minimizing the risk of severe and expensive mistakes.

Read MoreThe IRS has issued guidance providing additional details about investment in qualified opportunity zones.

Read MoreDon’t file and forget your tax return - use it to develop a financial plan! Find out more about the AICPA’s free webcast happening April 25th.

Read MoreThe IRS has released a Fact Sheet outlining the components and related details of the section 199A deduction, also known as the qualified business income deduction. Many individuals, including owners of businesses operated through sole proprietorships, partnerships, S-corps, trusts and setates may be eligible for this deduction.

Read MoreTax-related identity theft occurs when a thief uses someone’s stolen Social Security number to file a tax return and claim a fraudulent refund. The victim may be unaware that this has happened until they e-file their return.

Read More