New procedures that will enable certain individuals who relinquished their U.S. citizenship to come into compliance with their U.S. tax and filing obligations and receive relief for back taxes

Read MoreThe Estimator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

Read MoreThe EITC report presents an examination of the strengths and weaknesses of the EITC and makes recommendations to improve it.

Read MoreThis week the IRS issued the final regulations on the deductibility of charitable contributions which generate state and local tax credits.

Read MoreThe IRS reminded taxpayers who pay estimated taxes that Monday, June 17, is the deadline for the second estimated tax payment for 2019.

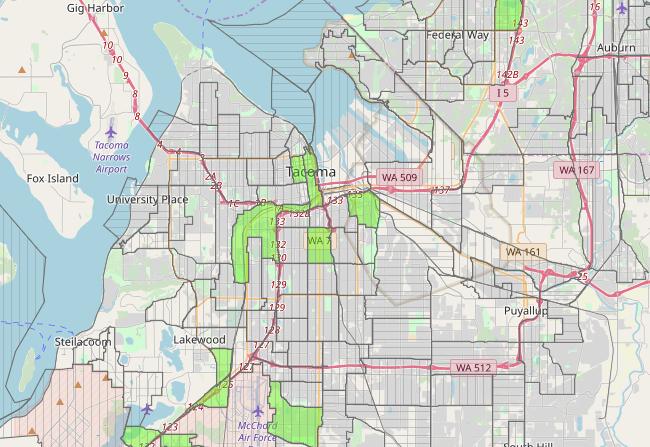

Read MoreThe IRS has issued guidance providing additional details about investment in qualified opportunity zones.

Read MoreIn Revenue Ruling 2019-11, the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit to determine the portion of any state or local tax refund that must be included on the taxpayer’s federal income tax return.

Read MoreReviewing withholding is especially important if people did a Paycheck Checkup in 2018 and adjusted their withholding during the middle or late in the year. Another review early this year can help make sure they’re having the right amount withheld for the rest of 2019.

Read MoreThe Treasury Department and the Internal Revenue Service issued final regulations and three related pieces of guidance, implementing the new qualified business income (QBI) deduction (section 199A deduction).