Here is an overview of some of the important changes and issues from the Tax Cuts and Jobs Act, as well as some actions you may be able to take before year-end to maximize your tax savings for 2018.

Read MoreCommonly referred to as the Tax Cuts and Jobs Act, TCJA, the tax reform law passed in 2017 nearly doubled standard deductions and changed several itemized deductions that can be claimed on Schedule A, Itemized Deductions. The following is an overview from the IRS on some of the changes.

Read MoreBusiness owners who actively participate in their business have historically been allowed a full deduction for any net business losses incurred during the year. However, the 2017 Tax Cuts and Jobs Act (TCJA) introduced new limitations that could catch some business owners by surprise come tax time.

Read MoreA new, 10 percent middle-income tax cut is conditionally expected to be advanced in 2019, according to the House’s top tax writer. This timeline, although already largely expected on Capitol Hill, departs sharply from President Donald Trump’s original prediction that the measure would surface by November.

Read MoreThe rehabilitation tax credit offers an incentive for owners to renovate and restore old or historic buildings. Tax reform legislation passed in December 2017 changed when the credit is claimed and provides a transition rule:

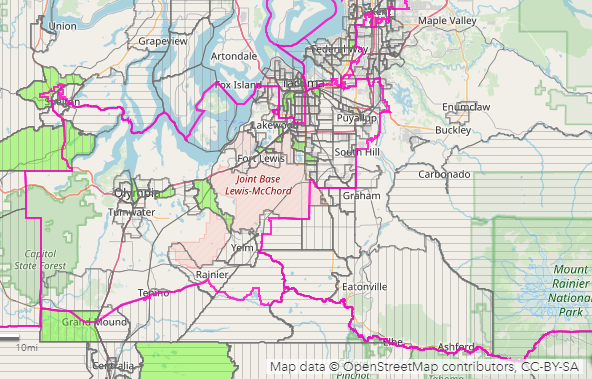

Read MoreA new tax provision contained in the 2017 Tax Cuts and Jobs Act (TCJA) provides a significant opportunity to defer the tax on capital gain from the sale of stock and other assets. Taxpayers who take the gain proceeds and invest them in certain economically distressed communities, known as Qualified Opportunity (QO) Zones, can qualify.

Read MoreRetirees should do a Paycheck Checkup to make sure they are paying enough tax during the year by using the Withholding Calculator, available on IRS.gov. The Tax Cuts and Jobs Act, enacted in December 2017, changed the way tax is calculated for most taxpayers, including retirees.

Read MoreThe Tax Cuts and Jobs Act (TCJA), which was signed into law last year, included a major change to the deductibility of business interest expense. Prior to passage of the act, business interest was, generally speaking, 100% deductible except in certain limited situations. The new rules apply to all businesses regardless of form, though there are notable exceptions for small businesses and certain industries.

Read MoreThe Tax Cuts and Jobs Act (TCJA) brought about many substantial changes for business and rental owners. Some of the biggest changes came to the accelerated expensing of capitalizable assets. The TCJA made significant changes to bonus depreciation, Section 179 deduction and depreciation of automobiles.

Read More