The Doty Group, P.S. is pleased to announce a new member of their organization, Alexandra Marler, CPA, MBA.

Read MoreDon’t miss these 1099-Misc deadlines in February!

Read MoreHere is an overview of some of the important changes and issues from the Tax Cuts and Jobs Act, as well as some actions you may be able to take before year-end to maximize your tax savings for 2018.

Read MoreThe Doty Group is reminding business owners of the rules and regulations with respect to the issuance of 1099’s for the 2018 calendar year, as it is the responsibility of business owners to comply with these reporting requirements.

Read MoreBusiness owners who actively participate in their business have historically been allowed a full deduction for any net business losses incurred during the year. However, the 2017 Tax Cuts and Jobs Act (TCJA) introduced new limitations that could catch some business owners by surprise come tax time.

Read MoreDo you know your business’s monthly break-even point? What is your client/ customer conversion rate? What is the utilization of your staff? How long does it take to bill and collect from clients/ customers? These questions highlight different Key Performance Indicators of which every business owner should be aware.

Read MoreThe Tax Cuts and Jobs Act (TCJA) made some changes to the deductibility of meals & entertainment expenses for the year beginning January 1, 2018. These changes caused some ambiguity over whether certain meals were 50% deductible or nondeductible.

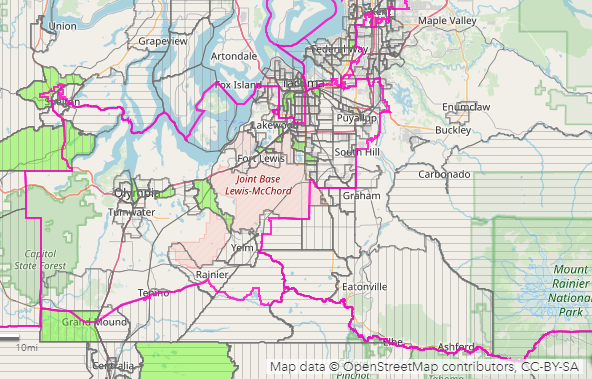

Read MoreA new tax provision contained in the 2017 Tax Cuts and Jobs Act (TCJA) provides a significant opportunity to defer the tax on capital gain from the sale of stock and other assets. Taxpayers who take the gain proceeds and invest them in certain economically distressed communities, known as Qualified Opportunity (QO) Zones, can qualify.

Read MoreThe Tax Cuts and Jobs Act (TCJA), which was signed into law last year, included a major change to the deductibility of business interest expense. Prior to passage of the act, business interest was, generally speaking, 100% deductible except in certain limited situations. The new rules apply to all businesses regardless of form, though there are notable exceptions for small businesses and certain industries.

Read More