During the week of December 3 - 7, the IRS, State Tax agencies, and the Tax Industry observed “National Tax Security Awareness Week” which has been an initiative to provide resources to individuals and businesses in the interest of protecting their tax data and identities ahead of and through the 2019 tax season.

Read MoreOn November 13, Doty Group Shareholder and Director of Litigation & Valuation, Shelley Adams Drury, CPA, CVA, ABV, CFF led a Webinar hosted by the International Society of Business Appraisers.

Read MoreDo you know your business’s monthly break-even point? What is your client/ customer conversion rate? What is the utilization of your staff? How long does it take to bill and collect from clients/ customers? These questions highlight different Key Performance Indicators of which every business owner should be aware.

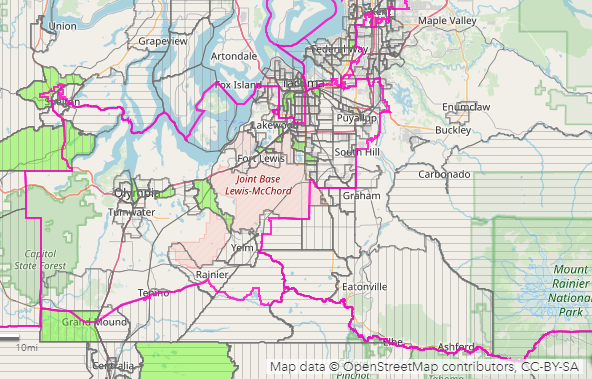

Read MoreA new tax provision contained in the 2017 Tax Cuts and Jobs Act (TCJA) provides a significant opportunity to defer the tax on capital gain from the sale of stock and other assets. Taxpayers who take the gain proceeds and invest them in certain economically distressed communities, known as Qualified Opportunity (QO) Zones, can qualify.

Read MoreThe Tax Cuts and Jobs Act (TCJA), which was signed into law last year, included a major change to the deductibility of business interest expense. Prior to passage of the act, business interest was, generally speaking, 100% deductible except in certain limited situations. The new rules apply to all businesses regardless of form, though there are notable exceptions for small businesses and certain industries.

Read MoreThe Tax Cuts and Jobs Act (TCJA) brought about many substantial changes for business and rental owners. Some of the biggest changes came to the accelerated expensing of capitalizable assets. The TCJA made significant changes to bonus depreciation, Section 179 deduction and depreciation of automobiles.

Read MoreWhat is a calculation of value? What circumstances might lend themselves to the need for a calculation engagement?

Read More