What To Know About the WA Cares Fund: Contributions, Eligibility, Benefits

Long-Term Services and Supports Trust Act

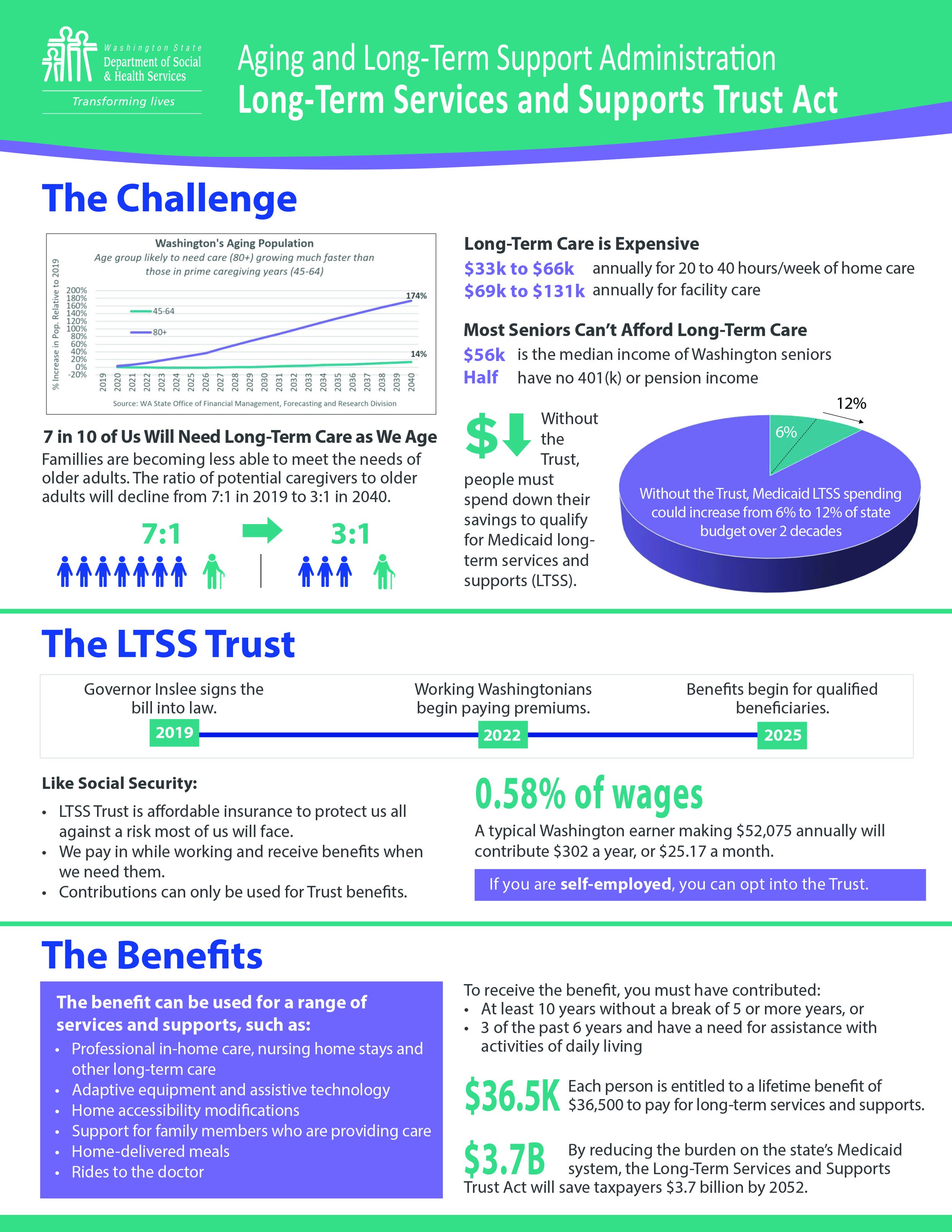

WA Cares Fund is a new publicly funded long-term care insurance that provides a basic level of long-term services and supports for working residents. Required by state law, the WA Cares Fund is administered by the Washington State Employment Security Department (ESD) and Department of Social and Health Services (DSHS).

The State’s intention behind this program is to ensure that residents secure long-term care coverage of up to $36,500 (adjusted for inflation) at a rate of .58% of their earnings only when they are working, versus doing so while taking time off for caregiving or during retirement.

While some of the fine print has yet to be set by the ESD, here is an overview of what information has been made available to the public regarding the collection of and exemption from the premium, as well as a list of benefits and their eligibility requirements.

Payroll Deduction, Rate and Collection

Beginning January 1, 2022, Washington workers will be required to contribute 58 cents per $100 of earnings through a payroll tax collected by the employer and remitted to ESD the same way they collect for Paid Leave. Employers will not be required to pay any share of these contributions for their employees.

What about those preparing to retire soon?

The premium will be deducted even for residents who are set to retire within the next few years and/or before they meet the requirements to qualify for benefits.

What can employers do to get ready?

By October 1, 2021, the ESD and DSHS will conduct joint outreach to provide employers with educational materials to ensure that employees are aware of the program and that employers are prepared to begin collection of the tax. (source) If employers already offer private long-term care insurance to employees, they can continue to do so. It is up to employees to decide whether to apply for exemption or pay for additional long-term care insurance on top of WA Cares Fund contributions.

The ESD has made an Employer Toolkit available through their website here.

From January 1, 2022 to January 1, 2025, self-employed workers such as sole proprietors, independent contractors, partners or joint venturers may opt in by filing a notice of election in writing with the ESD according to their instructions. They may also do so by electing for this coverage within 3 years of becoming self-employed for the first time.

Self-employed workers are responsible for payment of 100% of all premiums until they retire or are no longer self-employed, at which time they will need to file a notice with the ESD. At no time may they withdraw from coverage. They become eligible for benefits under the same guidelines mentioned in the “Eligibility” section of this article.

As of June 22, 2021, the ESD has yet to adopt the rules for determining hours worked and wages of individuals electing for coverage as self-employed individuals.

Opting Out

Individuals of 18 years of age or older who can demonstrate that they own a private long-term care insurance policy may permanently opt out of the program by applying for an exemption with the ESD and notifying their employer of approval.

To qualify for this exemption, the long-term care insurance policy must be purchased by November 1, 2021 and the policyholder must apply for the exemption between October 1, 2021 and December 31, 2022.

Approved exemptions take effect on the first day of the quarter immediately following the approval of the exemption, and exempt employees are not entitled to a refund of any premium deductions made before the effective date of the exemption.

If an employee opts out, can they opt back in?

The exemption is for life – once employees have opted out, they may not re-enroll and are considered permanently ineligible for coverage under the WA Cares Fund.

Employers are required to retain written notifications of exemptions from employees. If an exempt employee fails to notify an employer of an exemption, the employee is not entitled to a refund of any premium deductions. Employers are not entitled to a refund from the ESD for any premiums remitted erroneously from exempt employees.

Eligibility

Benefits are only available to eligible participants in the state of Washington. They are not transferable. Residents who move out of state for over 5 years will forfeit benefits and premiums.

The vesting period for benefits includes those who have worked at least 500 hours per year and contributed to the fund for either (a.) 3 of the past 6 years (from the date of application for benefits) or (b.) 10 years without a break of 5 or more years. Once the 10-year vesting period has been met, the benefits are available when needed.

Benefits

Beginning January 2025, eligible workers and retirees will be able to access $100 per day, up to a lifetime benefit of $36,500 of services and supports (adjusted for inflation).

These services and supports include (from providers of care who are approved through the Department of Social and Health Services):

Professional personal care at home, in an assisted living facility, an adult family home, or nursing home

Adaptive equipment technology such as hearing devices and medication reminder devices

Home safety evaluations

Training and support for paid and unpaid family members who provide care Home-delivered meals

Care transition coordination

Memory care

Environmental modifications like wheelchair ramps

Personal emergency response system

Respite for family caregivers

Transportation

Dementia supports

Education and consultation

Assistance Requirements

To qualify, vested Washington residents must be at least 18 years of age and require assistance with at least 3 activities of daily living, such as:

Medication management

Personal hygiene

Eating

Toileting

Cognitive functioning

Transfer assistance

Body care

Bathing

Ambulation/mobility

Dressing

Questions?

We are here to help answer your questions as more information becomes available. Our payroll provider affiliates check in with us continuously to ensure that our clients and their employees are equipped to make the best decisions as new guidelines need to be implemented. You can e-mail us at info@dotygroupcpas.com or submit an inquiry through our Contact page.